Green Bank for Appalachia, Energy Communities, and Underserved Rural America

THE GREEN BANK FOR RURAL AMERICA

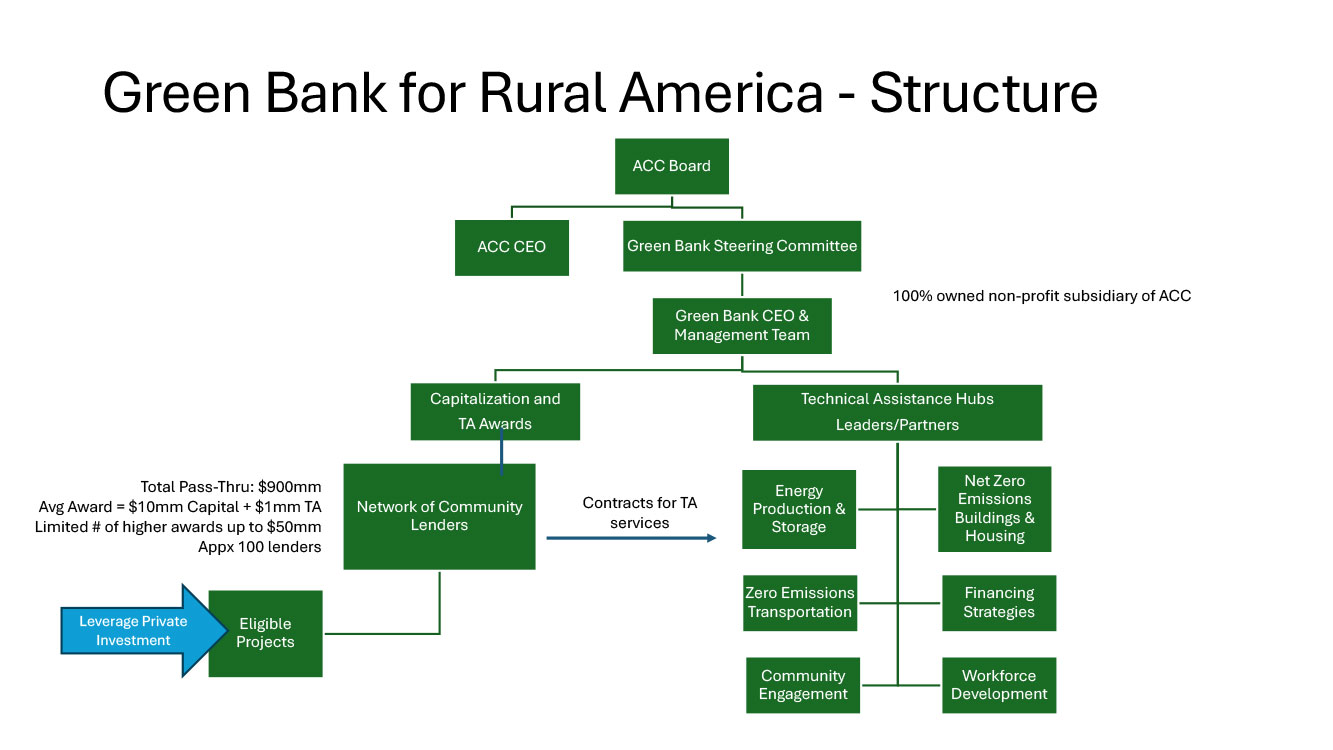

Appalachian Community Capital (ACC) has been selected for a $500 million award from the EPA Greenhouse Gas Reduction Fund CCIA program to catalyze green energy investments in low-income rural communities impacted by declines in the fossil fuel industry. To accelerate economic restructuring and diversification in these communities, ACC has established the Green Bank for Appalachia, Energy Communities, and Underserved Rural America (or Green Bank for Rural America for short), a place-based effort that will be a hub for investment and technical assistance to community lenders, local leaders, and workforce development partners across the United States.

Energy communities have powered the economic growth of our nation – from coal, to oil, to natural gas – yet the decline of legacy energy industries has resulted in some of the most economically distressed regions of the country. This economic hardship and lack of opportunity will be exacerbated by future coal and power plant closures.

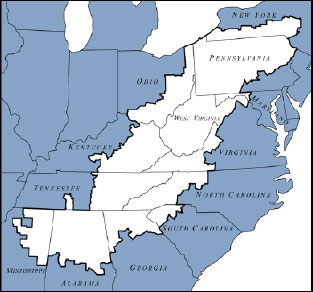

The Green Bank for Rural America has structured a robust national program that prioritizes 582 counties in Appalachia, energy and underserved rural, and Native communities – 30% of all US persistent poverty counties – with financing and technical assistance activities being available in all eligible underserved rural communities nationally.

To receive updates and information, including information on program launch, please provide your contact information via the Information Request Form.

IMPACT

ACC anticipates a $500 million EPA GGRF CCIA award will be used to leverage private capital to finance $2.25 billion in 2,750 clean energy projects, create 18,000 quality jobs in rural communities, reduce energy generation from carbon-based sources by 1.4M MWh annually, and reduce carbon emissions by 12M tons annually.

LEADERSHIP

The Steering Committee for this effort is composed of leading regional and national development finance organizations with a track record of high impact investments in low-wealth rural communities. This team has deep knowledge of community needs and financing opportunities, supporting thousands of transactions in the targeted rural communities, as well as exceptional expertise at structuring and managing development finance portfolios exceeding $5 billion. See below links for more information.

CAPITALIZATION FUNDING AND TECHNICAL ASSISTANCE AWARDS TO PARTICIPATING COMMUNITY LENDERS AND INVESTORS

The Green Bank will disburse Capitalization Funding and Technical Assistance Awards to participating CDFIs and other public and non-profit loan and investment funds, bringing new investment to target communities, creating quality jobs and businesses that support sustainable growth.

A total of $400 million in capitalization funding to ~100 participating community lenders and investors serving rural areas is anticipated to be provided. Most capitalization funding will be provided in commitments of $10 million or less, while some capitalization funding commitments are anticipated to range from $10 million – $50 million.

Participating Community lenders and investors will also receive Technical Assistance grants of 10% of their capitalization funding commitments. These grant funds may be used to support project development, provide pre-development services, expand lender / investor capacity, and provide other project support.

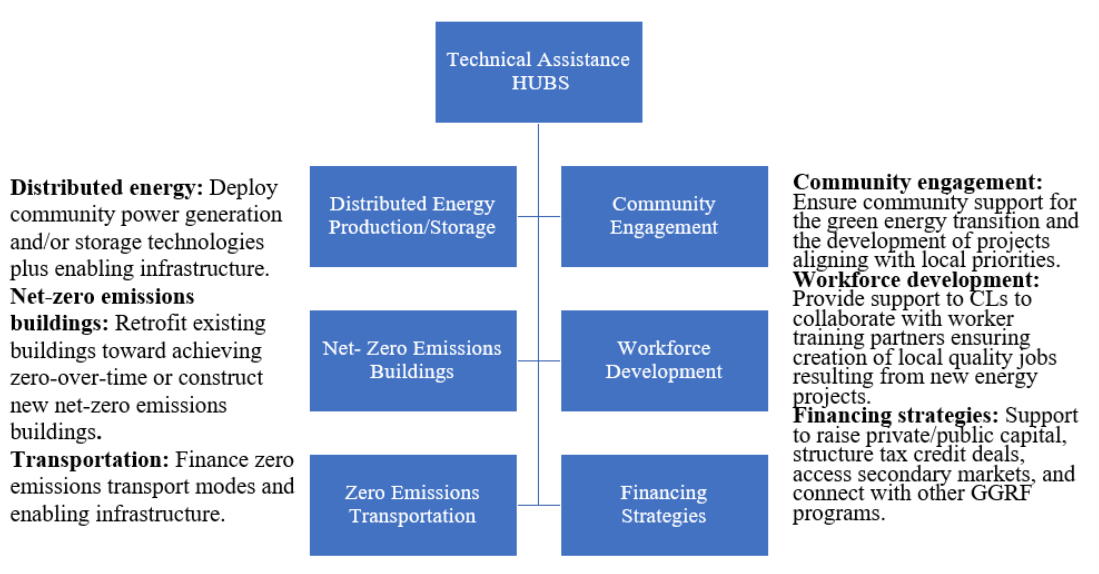

The Green Bank for Rural America will also provide Technical Assistance services to participating lenders and investors to build capacity, develop new products, and provide other support services.

The Green Bank for Rural America will be structured to be a self-sustaining entity.

COMMUNITY ENGAGEMENT AND WORKFORCE DEVELOPMENT

The Green Bank for Rural America will work closely with community engagement and workforce development partners to ensure financed projects address community priorities, and that new job opportunities are prioritized for local residents. Community engagement partners will include local community-based organizations, regional development organizations, local government leaders and others to ensure financed projects support a community’s vision and build on community strategies. Workforce development partners will include community and technical colleges, workforce boards, unions, and industry training and certification partners, ensuring that rural residents have an on-ramp to high quality employment opportunities in the new energy economy.

TARGET COMMUNITIES

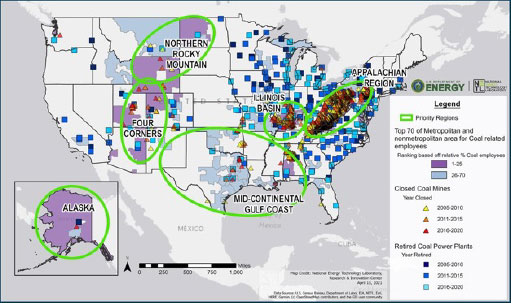

The Green Bank for Rural America will target the 13-state region of Appalachia, Coal and Power Plant Communities nationally, and other underserved rural areas such as Persistent Poverty Counties, NMTC Low Income Communities, federal Opportunity Zones and other areas. See link below for more information, and here

Appalachia – Appalachian Regional Commission

Coal Communities and Power Plant Closures –

White House Interagency Working Group

LINKS FOR ADDITIONAL INFORMATION:

Green Bank for Rural America Program Overview (3/2024), in PPT – download here

Green Bank for Rural America Program Summary (10/2023), in PDF – download here

Informational Webinars – recorded sessions:

- September 11, 1:00 ET – for Community Lenders and Investors: CDFIs, public and non-profit loan funds, public and non-profit investment funds. View Recorded webinar here. View presentation deck here.

- September 11, 2:00 ET – for Community Engagement partners: for Community Based Organizations, local government leaders, Regional Development Organizations, and more. View Recorded webinar here. View presentation deck here.

For Informational Updates:

For periodic updates on Green Bank for Rural America activities, including information on upcoming informational webinars, please provide your contact information here.