Western North Carolina Small Business Initiative

Appalachian Community Capital & the Western NC Small Business Initiative

Through the Western North Carolina Small Business Initiative (WNCSBI), Appalachian Community Capital and our partners are helping local entrepreneurs access the funding, guidance, and support needed to grow and thrive.

Watch how collaboration and investment are fueling small business resilience across the region.

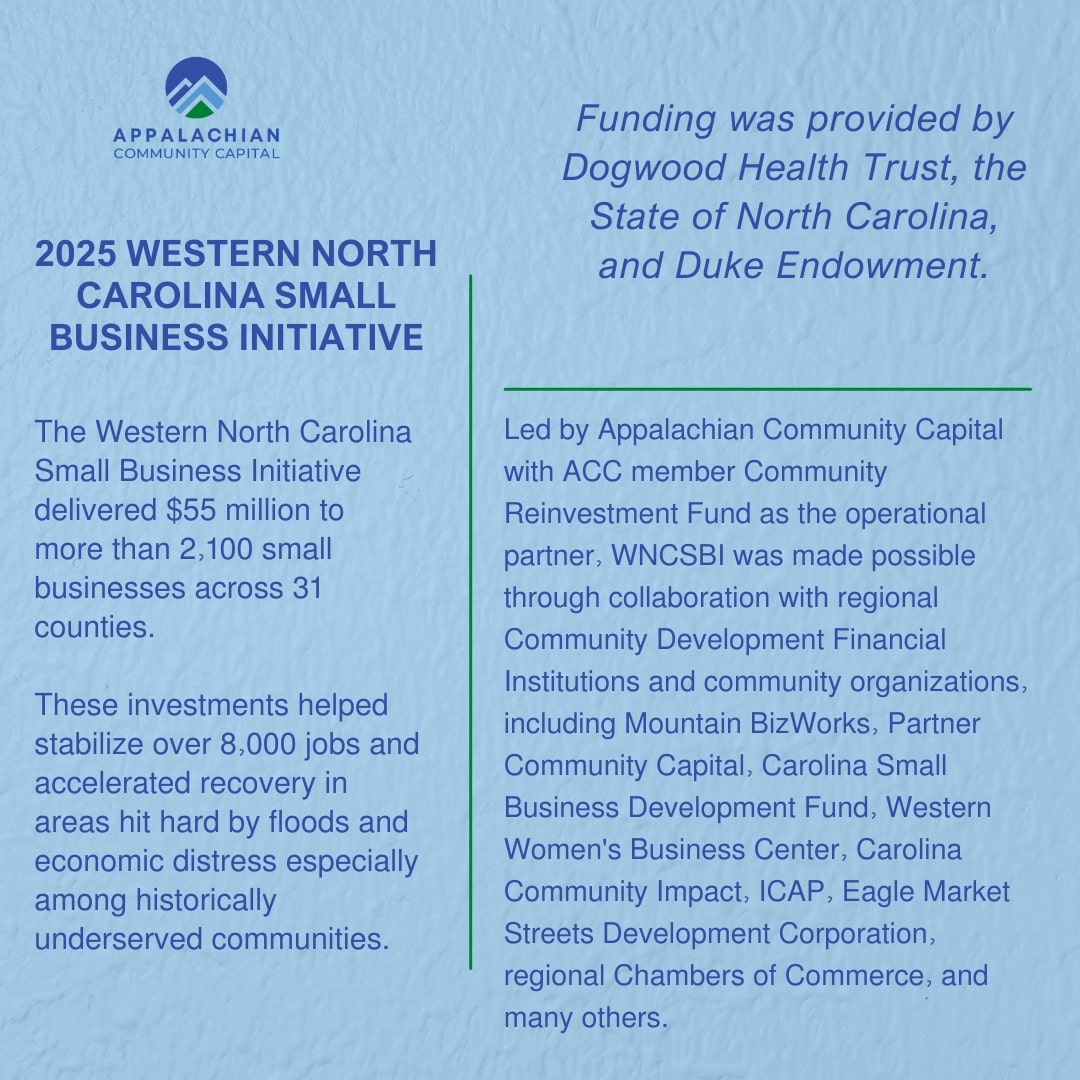

Explore how the Western North Carolina Small Business Initiative empowered over 2,100 businesses across 31 counties—supporting more than 8,000 jobs and fueling resilient recovery in historically underserved communities.

View the Profiles

![WNCSBI_Infographic_9.4.25[1]](https://appalachiancommunitycapitalcdfi.org/wp-content/uploads/2025/09/WNCSBI_Infographic_9.4.251.jpg)

Tiny Bridge Farm

Hendersonville, NC

Ed Grave

Ed Graves wasn’t born into a farming family. However, after working on vegetable farms in Vermont as a teenager, he found that he liked working outside and the whole life cycle of crops, and so he set his sights on having his own farm someday.

To that end, he earned a degree in agricultural science from the University of Wisconsin-Madison and gained more work experience at some large organic production farms in the Midwest. In 2010, he moved to Western North Carolina and started Tiny Bridge Farm.

The field at the homestead that Ed purchased was just a third of an acre, and his original mission was to start an organic production farm as well as to experiment with the region’s longer growing season to see how many different crops he could grow. There were very few production farms in the area that grew organic, natural food, and he began selling his produce to local community supported agriculture (CSA) customers.

In recent years, Tiny Bridge Farm has expanded to five acres and produces thousands of pounds of mixed vegetables each year, all distributed within 20 miles of the farm. It still serves CSA customers but sells primarily to the public at farmers’ markets as well as to a variety of wholesale customers, including specialty grocers, food pantries, and restaurants.

As Hurricane Helene approached Western North Carolina, the forecast for Ed’s area was for more than four inches of rain in a short period of time. The day before the storm was expected to hit, Ed and his team focused on working with a backhoe operator to prepare their fields to drain.

What Ed and no one else in the area could have expected was the 20 inches of rain they received in two days. The deluge covered Ed’s fields with 15 to 20 feet of water. The farm lost all of the crops Ed planned to harvest in October, November, and part of December.

The storm also destroyed the farm’s high tunnels, the plastic-covered, hoop-shaped structures that Ed used to protect his crops from the elements and to extend the growing season.

Tiny Bridge Farm depends on skilled agricultural labor that is critical to its long-term viability. A $25,000 grant from the Western North Carolina Small Business Initiative enabled Ed to keep his team of six employed after the hurricane as well as to purchase soil, seeds, compost and other essential supplies for the next growing season. He hopes to leverage the balance of the grant funds with additional federal funding to rebuild the high tunnels and other infrastructure destroyed by Helene.

“We appreciate our staff. They showed up for us, and we showed up for them,” Ed said. “We also saw how our community rallied after the storm to take care of each other and also to express concern for our business and to encourage us to continue. We were surprised by how our connection with people in our community became a lot deeper, and that gives us hope and helps us to keep going.”

SoundSpace@Rabbit’s

Asheville, North Carolina

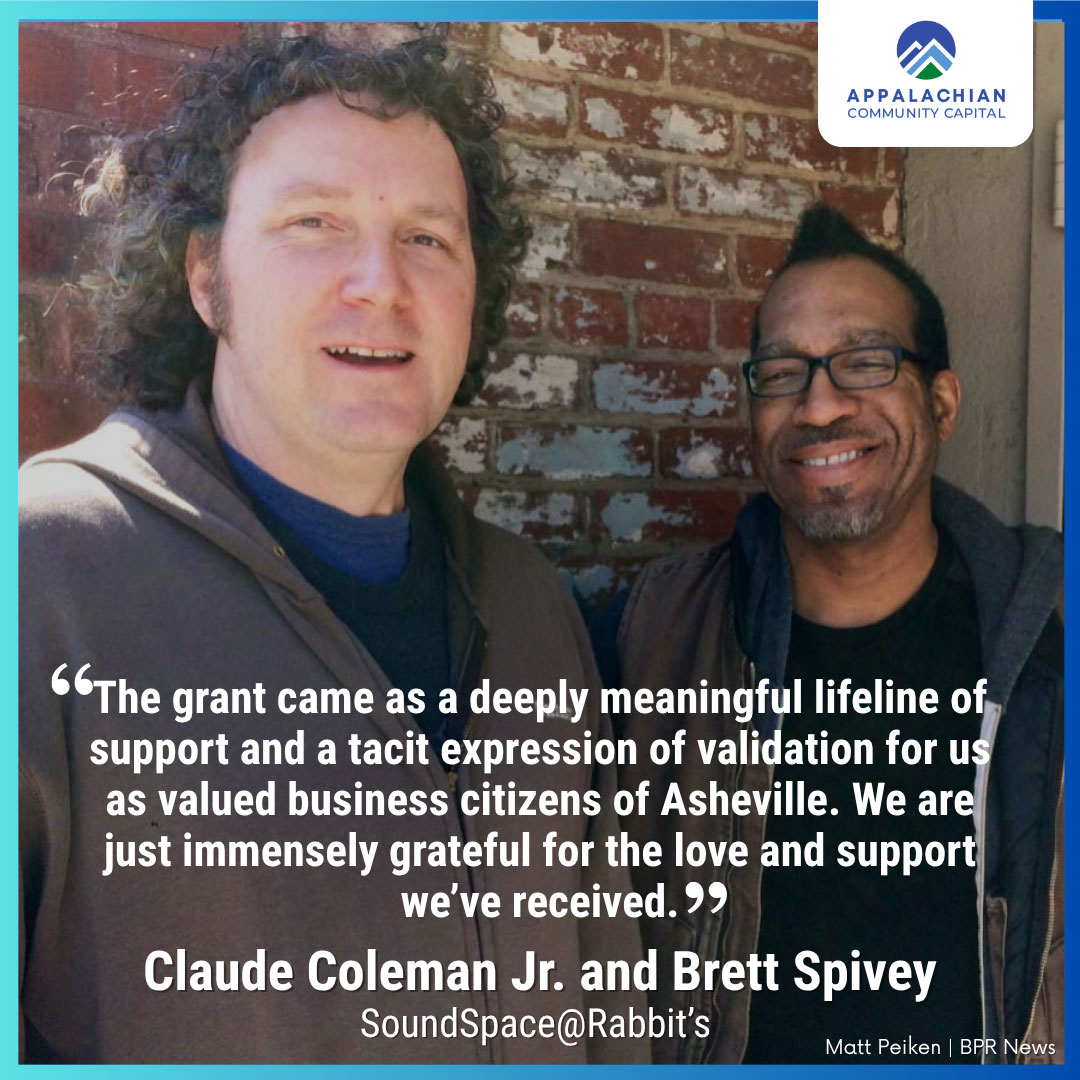

Claude Coleman Jr. and Brett Spivey – Co-founders and Co-owners

When Claude Coleman Jr. and Brent Spivey started SoundSpace in 2020, their vision for their new business went well beyond business.

Claude and Brett both have deep experience in music. An Asheville native, Claude is a veteran multi-instrumentalist, songwriter, recording and performing musician, ex-music school director and teacher, and 30-year drummer for the group Ween. Brett, also an Asheville resident, is a multi-instrumentalist, performing and recording artist, and producer.

They were well aware that, despite Asheville’s thriving music scene, there was a lack of affordable rehearsal space for musicians. They envisioned SoundSpace as a creative arts hub where performing artists could connect in a shared space, practice their art, and help grow the Asheville music industry.

But that was only one part of their vision.

The other part was to help preserve the memory of an important period in the history of Black Asheville and to share it with all of the city’s communities for generations to come. To that end, they secured a loan from Appalachian Community Capital that enabled them to renovate Rabbit’s Motel—a Black-owned tourist court and soul food café that opened in Asheville’s historically Black Southside in 1947 and served African-American travelers throughout the Jim Crow era—and to transform it into SoundSpace.

Claude and Brett’s new business soon evolved into a facility with two state-of-the-art rehearsal studios for rent, each equipped with an array of equipment, including drum kits, bass and guitar combo amplifiers, a public address system with monitors, and keyboard controllers used to input musical data into a computer or other Musical Instrument Digital Interface (MIDI) device. SoundSpace also offers an unequipped solo rehearsal room and a variety of gear for rent.

Hurricane Helene threatened to destroy Claude and Brett’s growing business. The rushing water in the creek in back of the property caused extensive soil erosion that reached to within a foot of the building and left a sheer drop-off. The building and its foundation were not damaged, but SoundSpace would need to build a retaining wall running the entire length of the property and to remove contaminated soil and regrade the space to create a gentle slope between the building and the creek.

SoundSpace also lost power for a week and water for more than two months and was unable to reopen. Its doors remained closed for four months. Even when they finally did reopen, the decline in the arts, music, and tourism industries in Asheville persisted, and, like many small businesses in the region, SoundSpace suffered significant economic injury from lost revenue.

A $15,000 grant from the Western North Carolina Small Business Initiative provided Claude and Brett with much-needed working capital to cover their operating expenses while SoundSpace was closed and to offset their losses after it reopened. “The grant came as a deeply meaningful lifeline of support and a tacit expression of validation for us as valued business citizens of Asheville,” Claude said. “We are just immensely grateful for the love and support we’ve received.”

Claude especially appreciated that the support from the WNCSBI came in the form that it did. “Disaster relief assistance in the form of grants is few and far between,” he said. “As a business, we are already leveraged to our threshold, and taking on additional debt isn’t beneficial in the long term.”

Although SoundSpace has reopened, it hasn’t fully recovered. Claude and Brett have had to wait for seven months for the plans for the construction of the retaining wall and the regrading of the soil to be drawn up and are busy raising additional funds to pay for the work.

Still, while Claude acknowledges that Asheville has suffered deep trauma and the timeline for the recovery of its arts and music industries is unknown, he has confidence in his hometown and in SoundSpace. “Asheville is so resilient and has such strength and passion in its communities,” he said. “The question of when isn’t an issue. It’s how it will recover and what the recovery will look like. We look forward to being an integral part of the recovery of Asheville’s creative soul.”

Trackside Studios

Asheville, NC

Julie Ann Bell and Michael Allen Campbell, Owners and Managers

When three local artists, Lynn Stanley, Julie Ann Bell, and Michael Allen Campbell, began renting separate studios at 375 Depot Street in Asheville’s River Arts District in the early 2010s, they could hardly have imagined how their vision for their work and their studios would evolve.

In the beginning, the three simply focused on their own art. As time passed, however, they expanded into three additional spaces and welcomed other artists to join them. Then, in 2015, Lynn, Julie, and Michael incorporated as LJM Art Inc. and founded Trackside Studios in 2015, and the original group of three artists grew into a collective of 12.Their vision was to create a space where artists from a wide range of artistic backgrounds could meet, work, learn, and share their art with each other and the larger community. By 2018, the Trackside collective numbered 30 artists.

In August 2023, new owners, the Hellman family, purchased the building and, in collaboration with Julie and Michael, who had become Trackside’s owners and managers, began making extensive repairs and renovations to the property. These included expanding Trackside’s studios on the first floor, creating new studios on the second floor, and transforming a utility space into an arts classroom. When the renovations were finished in early 2024, Trackside had expanded to 5,300 square feet and was subletting studio and gallery spaces to 60 artists. Trackside’s future was looking bright.

Then came Hurricane Helene.

When the floodwaters inundated the River Arts District on September 27, 2024, the basement at 375 Depot Street—the space where Trackside stored their art supplies and tools for maintaining the studios—was completely flooded. The first floor, where 40 of Trackside’s 60 artists had their spaces and Trackside had its arts classroom and instructors’ supplies, flooded up to six feet. The artists on the first floor lost 60 to 100 percent of their art, and many lost their art supplies. Julie and Michael lost nearly all of their own art.

The Hellman family, led by son Sam, was determined to save Trackside. Just days after the flood, he and teams of workers started cleaning out the mud and debris, removing drywall, running dehumidifiers and air purifiers, and treating the space to prevent mold. Julie and Michael committed to Sam’s ambitious goal of reopening the business in December 2024, even though they had no clue how they would be able to do that.

One of the main obstacles, aside from the extent of the damage, was that Julie and Michael had already contributed $20,000 of their own money for the renovation of Trackside in 2023. Moreover, since founding Trackside in 2015, they had never taken an income from the business, except for a modest 15 percent commission from their artists’ sales to pay for advertising and operational expenses. They doubted that they could pay for a second renovation only months after the first one.

Julie and Michael were grateful when one of Trackside’s artists started a GoFundMe campaign, which proved successful and enabled them to reimburse their artists for the October rent they had already paid and to waive their November rent. They also used those funds to help purchase display supplies for their artists and to provide a stipend to instructors who had lost teaching materials when the classroom flooded.

Their good fortune continued when hundreds of volunteers began to show up to help rebuild the River Arts District. On some days, Trackside had as many as 20 to 30 volunteers working alongside Sam and his teams as well as Julie and Michael. They were artists, members of the community, and visitors from up and down the East Coast. There were even two young people from Norway who had been in Washington, D.C., and headed to Asheville because they wanted to help. And help they did—all of them. They hauled debris, painted walls, and did anything else they could to make the renovation of Trackside progress more quickly.

Julie and Michael also applied for—and received—a $10,000 grant from the Western North Carolina Small Business Initiative. They combined those funds with $5,000 they had received through another grant program and used the money to replace the drywall, point-of-sale system, sound system, packaging materials, wall painting supplies, shelving, sinks, and tables and chairs for the classroom.

On December 1, 2024, Trackside reopened its studios to its artists. And starting on December 6, they held a holiday market that was open through the end of the month. Trackside has now reopened fully and is open daily.

Julie and Michael remain deeply grateful for all of the support that the Hellman family and the countless volunteers provided to help Trackside get back in business. They are also deeply aware that their grant from the Western North Carolina Small Business Initiative played a critical role in Trackside’s survival.

“If it hadn’t been for the grant, I don’t think we could have rebuilt. We certainly couldn’t have met the timeline that Sam Hellman had envisioned,” Julie said. “But this grant made reopening possible. In doing so, it allowed 60 artists to return to their creative home. We would not be here without this grant. Thank you!”

Platt Dental Studio

A River Arts District – Asheville, NC

Dr. Kristi Platt. DDS, MS

Dr. Kristi Platt had worked in dentistry for 23 years, including in army field dentistry and community health, before she launched her own practice in downtown Asheville in 2022. Her vision was to provide gentle, collaborative dental services for the whole family and to offer early morning, late afternoon, and Saturday appointments to make going to the dentist more convenient. The Platt Dental Studio soon established itself in the community, earning Best of Asheville awards in 2022 and 2023.

When Hurricane Helene devastated Asheville on September 27, 2024, the future of Dr. Platt’s successful practice was suddenly in jeopardy. The office was located at a higher elevation and wasn’t damaged, but its electricity and internet service went out. The biggest problem, however, was the water. The flooding destroyed much of the city’s water system, and for thousands of people and businesses—including Dr. Platt’s studio—there was no source of clean, safe drinking water.

Dr. Platt closed her studio. She didn’t want to lose her four employees, and so she continued to pay their salaries. When local officials warned that city services might not be restored until January, she worried about how long she would be able to provide those steady paychecks.

Even though the studio was closed, Dr. Platt knew that she needed to continue seeing at least some of her patients. When her spotty internet connection was actually working, she was able to email her patients and identify those who were in severe pain and needed to be seen immediately. A local dental office that had been able to stay open allowed her and her team to use one of its rooms to treat those emergency patients. That was a great relief, but she still had to postpone many other appointments, and the lost revenue added to her financial burden.

Her studio finally reopened three weeks after the storm had hit, but Dr. Platt didn’t know if her business was going to survive. That changed, however, when she applied online for a grant from the Western North Carolina Small Business Initiative and received the money just a few weeks later.

Over the next three months, she used the $25,000 grant to continue paying her staff and to catch up on some business loan payments that she had had to postpone while her business was recovering. By the end of 2024, the Platt Dental Studio was getting back to being as busy as it was before the hurricane, and Dr. Platt had not lost a single employee.

“I had no idea that we would actually receive the grant. It just felt like a leap of faith,” Dr. Platt said. “I’m just so grateful. It makes me want to pay this blessing forward—to give to organizations that help out during disasters or give grants to other small businesses that may need financial assistance.”

Claywood

Hendersonville, North Carolina

Carly and Scott Buntin, Co-founders and Co-owners

Carly and Scott Buntin were living their dream when they opened Claywood, their restaurant in Hendersonville, North Carolina, in November 2023. Little did they know that a hurricane would threaten to destroy their new business less than a year later.

The couple had met in San Francisco in 2013 and soon discovered that they shared a love for fine dining. After marrying and starting a family, they decided that they wanted to start their own restaurant. They also decided that they wanted to raise their children in a place with a slower pace of life and a deeper sense of community. And so they left California and relocated to Western North Carolina. They hoped that their kids would grow up with a genuine love of the land as well as an appreciation of the challenges—and the joys—involved in building a small business like Claywood from the ground up.

Carly and Scott envisioned Claywood as a place that would combine exceptional hospitality, locally sourced ingredients, and craft beverages. Their mission was two-fold: to deliver an elevated yet welcoming dining experience to their community and to help support local farmers and suppliers whose livelihoods depend on small businesses like Claywood.

Claywood was doing well but still finding its financial footing in Hendersonville—a town of less than 16,000 located 25 miles from Asheville—when Hurricane Helene struck in September 2024. Although the restaurant sustained no major structural damage, the subsequent power outages, water quality issues, and supply chain disruptions were significant. Carly and Scott were forced to close for more than a month.

Losing that much revenue during what should have been a strong season for them was devastating for their new business. But Carly and Scott remained committed above all to supporting their employees during the closure and recovery—while often worrying whether Claywood would actually recover.

A $5,000 grant from the Western North Carolina Small Business Initiative proved to be a lifeline for Claywood at a time when it was most vulnerable. Carly and Scott received the grant a few weeks after submitting an application and put the money to work immediately. Claywood has now reopened and is rebuilding its business.

The restaurant primarily serves local and regional guests from Hendersonville and the greater Asheville area, but it has also begun to see an increase in tourists and travelers who appreciate its focus on farm-to-table dining and craft beverages. Carly and Scott estimate that it may take a full year for Claywood to recovery fully, but they know they will recover, thanks in large part to the Western North Carolina Small Business Initiative.

“The grant ensured that we could provide stable jobs during the critical recovery period and keep our team employed and focused on delivering quality food and hospitality,” Carly said. “In addition, it enabled us to maintain strong partnerships with our local farmers and suppliers. We are deeply grateful to the Western North Carolina Small Business Initiative for recognizing the needs of small businesses like ours and for providing this extraordinary support.”

Paws Mobile Veterinary Clinic

Black Mountain, NC

Paws Mobile Veterinary Clinic has a staff of two: Dr. Leslie Dragon, the veterinarian, and Heather Collins, the “everything else”—vet tech, office manager, receptionist, and, since March 2025, partner. The team is truly mobile, delivering a variety of high-quality veterinary services to their clients’ homes from a specially outfitted Ford Transit cargo van rather than operating from a permanent location.

The company started in Newport News, Virginia, in 2012 and relocated to Asheville in 2021. Among their clients are residents of retirement homes and other elderly and disabled people who can’t drive, don’t have cars, and can’t afford services from traditional vets. Paws Mobile also hosts weekly, low-cost neuter clinics for cats in lower-income communities and provides low-cost veterinary services to local nonprofit animal rescue organizations.

Hurricane Helene destroyed Paws Mobile’s most important asset—its cargo van. The storm was so powerful that the pounding rain ripped open the top of the vehicle and soaked all of its contents. Two days later, hordes of ants invaded the interior and started to devour the damp particle board. When a mechanic declared their beloved van a total loss, Dr. Leslie and Heather had it towed to the junkyard.

When they learned that their insurance wouldn’t cover the damage to their vehicle, Paws Mobile had no choice but to close. What helped them get back on the road was a $10,000 grant from the Western North Carolina Small Business Initiative, which they combined with an unsolicited and completely unexpected $20,000 donation from a nonprofit in Indiana that supports companion animals with special needs. The funds enabled Paws Mobile to purchase a used 2021 Ford Transit cargo van with 60,000 miles—the last one still for sale in the Asheville area—and to outfit it with enough equipment, medicines, and vaccines to allow them to start serving the community again.

Paws Mobile is still recovering from the storm, but they know they wouldn’t have been able to reopen at all without the assistance of the Western North Carolina Small Business Initiative. “This grant has allowed us to get back on our feet and start helping the animals of Western North Carolina again,” Heather said. “We cannot thank you enough.”

Oakland Cottage Bed and Breakfast

Asheville, North Carolina

Mary Kelton Bridges – Owner

Oakland Cottage Bed and Breakfast is a beautifully renovated, 5,000-square-foot Craftsman-style cottage offering seven comfortable guestrooms and spacious common areas that create a warm and welcoming ambience. Guests enjoy easy access to local attractions, including downtown Asheville, the Biltmore Estate, and the Blue Ridge Parkway. The property has a rich history. It was built in 1910 as a private home and in the 1930s and 1940s served as a sanatorium for tuberculosis patients. After extensive renovations that preserved the cottage’s original glass and woodwork, it opened as Oakland Cottage Bed and Breakfast in 2002.

“When guests stay with us at Oakland Cottage, they know where they are. They know they are in Asheville, in Western North Carolina, and not in just any hotel in just any city,” said Mary Kelton Bridges, Oakland Cottage’s owner. “We are Asheville.”

Autumn is usually a very busy time for Oakland Cottage. The B&B was 90% booked when Hurricane Helene struck on September 27, 2024. The storm caused a huge oak tree in a neighbor’s backyard to topple onto the cottage, creating a large hole in the roof and damaging several guestrooms. Thankfully, no one was injured. But Oakland Cottage closed immediately and lost 100% of its reservations for the coming months.

Still, they persevered and continued to serve their community.

Jim and Erica, the B&B’s resident innkeepers, had stocked up on food to prepare for the busy October they were expecting. But when the power went out, they emptied their refrigerator and freezer, set up a table on the street, and gave away any food that might go might go bad. They also collected eggs from the chickens in the property’s backyard and delivered them to their neighbors.

Once Oakland Cottage regained its power and internet service in mid-October, they even opened their living and dining rooms to neighbors and locals so they could come in and enjoy a bottled water, do some work on their computers, and chat with others. The informal gathering place was soon nicknamed the Little Helene Café.

“One of the great things about bed and breakfasts is that we’re in neighborhoods and we’re neighbors, really neighbors,” Mary said. “Jim and Erica and our assistant innkeeper Britt just hung in there during this incredibly traumatic time and were such good neighbors.”

Oakland Cottage remained closed for nearly six months and finally reopened in March 2025. Mary credits the $25,000 grant Oakland Cottage received from the Western North Carolina Small Business Initiative with enabling her to continue paying her three employees during that time. She also credits the grant and the community with helping to raise the morale at the B&B and in its neighborhood.

“We all lifted each other’s spirits is what it comes down to. I mean, you just need that emotional support, and communities do that. People just do the right things when the moment comes,” Mary said. “And that’s what the grant meant to me, too. It felt like community support and beyond that. That was the bright side of everything that happened—feeling uplifted by everyone.

Luther Trucking Inc.

Asheville, North Carolina

Joey and Kathy Luther, Co-founders and Co-owners

Joey and Kathy Luther started Luther Trucking in July 2006. It has always been a small company. At times, they have had as many as four trucks running and a few other drivers on staff. But these days, Joey, who has driven all kinds of vehicles, including tractor-trailers, tour buses, and charter buses, during the past 50 years, does most of the driving and maintains the trucks. He and Kathy share responsibility for the dispatching. And Kathy handles all the paperwork and billing and anything else that comes up.

Their business is to transport building supplies—primarily polyvinyl chloride (PVC) pipe, a type of plastic pipe used in plumbing, well casing, irrigation, and many other industrial and agricultural applications—to and from Western North Carolina. Since the very beginning in 2006, Luther Trucking’s primary client has been the Asheville production facility of Silver-Line Plastics, a manufacturer of some of the highest quality plastic pipe products made in the United States.

No doubt, one of the key reasons for Luther Trucking’s success is that Joey and Kathy have always been people persons. “Over the years, I would go with Joey on trips. We would take customers out to dinner and develop the kind of relationships where people would text us and say, ‘My grandmother’s sick, please pray for her,’” Kathy said. “The relationships we developed with people are more than just business relationships. We look at business as more, so much more, than just taking pipe from one place to another.”

Hurricane Helene dealt a double blow to Luther Trucking. They had parked four of their five semi-trucks on the upper end of Silver-Line’s property, which in past years floodwaters had never touched. But Hurricane Helene was not just another storm. All four of Luther Trucking’s trucks were covered with water up to their roofs and completely destroyed. Silver-Line’s facility also was completely submerged.

The result was devastating for Joey and Kathy. They were forced to close for three months and had no business and no revenue during October, November, and December. Silver-Line also shut down for cleanup and recovery. So Luther Trucking not only lost their most valuable equipment but also their most important client. Insurance money eventually enabled Joey and Kathy to buy another truck, which meant that they would have two trucks out on the road trucks when business picked up. But they still had other urgent expenses.

Fortunately, they received a $25,000 grant through the Western North Carolina Small Business Initiative. They used the money to continue repairing and replacing the trailers and other equipment and materials that had been damaged or destroyed. The grant also helped them pay their other driver during the months when there was no work.

Silver-Line reopened on a small scale in January 2025, and so did Luther Trucking. Joey and Kathy estimate that it will take their business at least a year to recover fully and Silver-Line even longer, but they know that they are moving forward once again.

“The grant was an answer to our prayers and a huge blessing from the Western North Carolina Small Business Initiative and our Father in Heaven,” Kathy said. “It helped us to stay afloat during a time when we could not work and to return to being a productive and helpful part of this community that we love.”